Lowe’s Dividend Scorecard: Rating the Home Improvement Giant’s 2% Payout

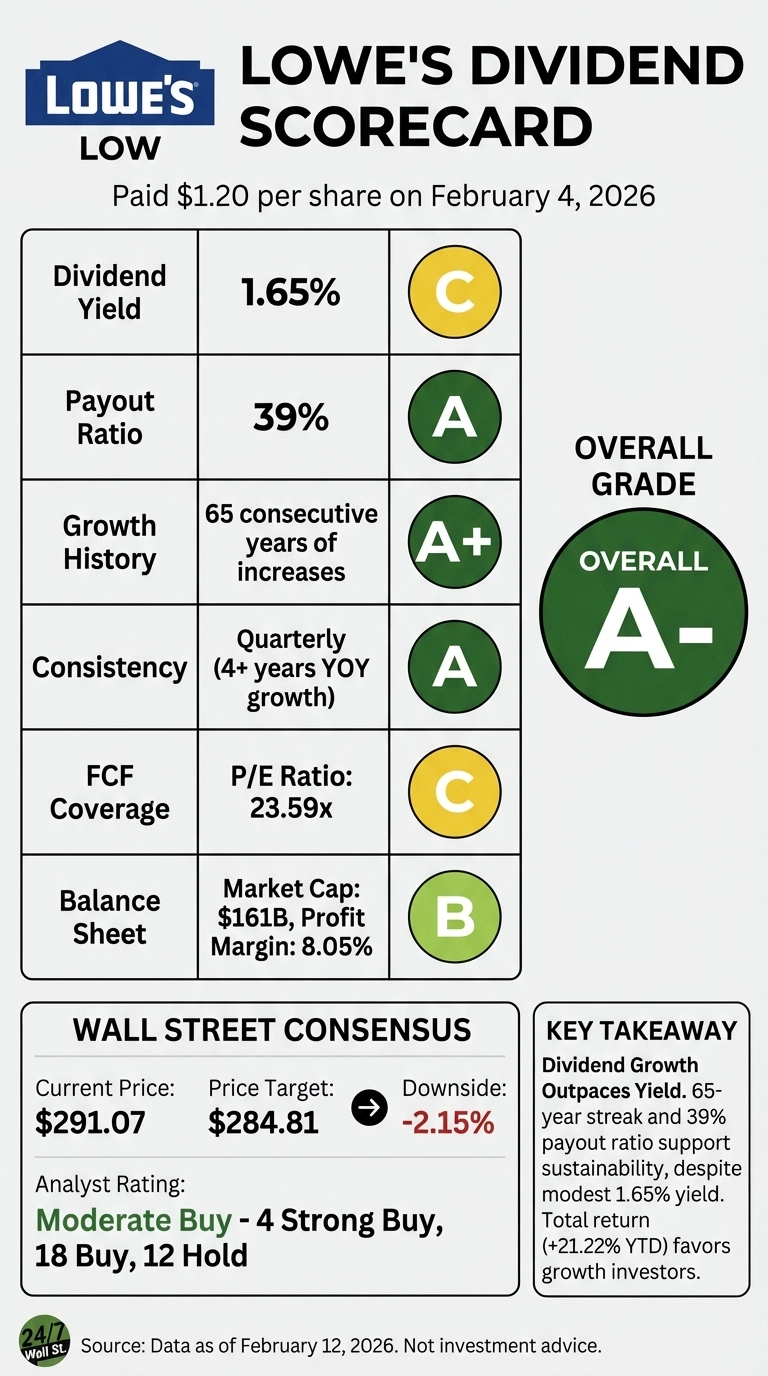

Lowe’s paid its latest quarterly dividend of $1.20 per share on February 4, 2026, marking another milestone in the home improvement retailer’s 65-year streak of consecutive dividend increases. With shares trading at $291.07 as of February 12, 2026, the current quarterly payout translates to a 1.65% annual yield. While that figure trails the broader market’s income opportunities, Lowe’s dividend story deserves closer examination beyond the headline number.

Dividend Growth Outpaces Yield

The modest yield masks meaningful growth. Lowe’s raised its quarterly dividend from $1.15 to $1.20 between Q2 and Q3 2025, representing a 4.3% quarterly increase. Over the past two years, the annual dividend has climbed from $4.35 in 2023 to $4.70 in 2025, an 8% two-year gain. That growth trajectory matters more for long-term income investors than the current yield snapshot.

The company’s dividend sustainability looks solid. With trailing twelve-month earnings of $12.17 per share and an annual dividend of $4.70, Lowe’s maintains a 39% payout ratio, leaving substantial room for future increases even if earnings face pressure. The retailer generated $84.3 billion in revenue with an 8.05% profit margin, providing a stable cash flow foundation.

Retail Sector Comparison

Lowe’s dividend profile diverges sharply from retail peers. Home Depot, the direct competitor, offers a 2.36% yield on its $9.20 annual dividend – 43% higher than Lowe’s in absolute yield terms. Home Depot also demonstrates stronger recent growth momentum, raising its quarterly payout from $2.25 to $2.30 in 2025, though the 2.2% increase lags Lowe’s percentage gain.

Walmart presents an entirely different profile: a 0.72% yield with a $0.235 quarterly dividend. Target splits the difference at 4.01% yield with a $1.14 quarterly payment, though the retailer’s stock has declined 6% over the past year compared to Lowe’s 18.62% gain.

The total return picture favors Lowe’s. Shares have surged 21.22% year-to-date through February 12, significantly outpacing Home Depot’s 14.46% gain and Target’s 18.4% increase. When dividend income combines with capital appreciation, Lowe’s delivers competitive results despite the lower starting yield.

Valuation and Analyst Perspective

Recent analyst activity suggests cautious optimism. Citigroup raised its price target to $285 from $250 on February 11 while maintaining a Neutral rating, and TD Cowen lifted its target to $295 from $250 with a Hold rating. Both firms cited dividend growth appeal and noted that housing market concerns may be overstated, as homeowners shift spending toward improvements when housing supply tightens.

The stock trades at 23.59 times trailing earnings, a premium to Target’s 13.71 multiple but below Home Depot’s 26.67 ratio. Lowe’s $161 billion market capitalization reflects investor confidence in the business model, though it remains roughly half of Home Depot’s $389 billion valuation.

Business Momentum and Headwinds

Operational initiatives support the dividend trajectory. The company launched MyLowe’s Rewards Kids Club in early February 2026, targeting family engagement with DIY projects. A new 124,000-square-foot Celina, Texas location opened more than a year ahead of schedule, demonstrating execution capability despite construction challenges.

Housing market dynamics present the primary risk. The sector faces affordability pressures that could dampen home improvement spending in 2026. However, research cited by analysts shows 87% of parents find DIY projects rewarding family time, suggesting consumer behavior may support demand even if housing transactions slow.

Insider activity sends mixed signals. CEO Marvin Ellison sold 18,000 shares for $4.70 million in Q3, reducing his ownership by 7.23%. Meanwhile, institutional investors show divergent views: Willis Investment Counsel increased its stake by 6.9% in Q3 while Aurdan Capital Management reduced holdings by 10.6%.

The Verdict on Quality

Lowe’s dividend earns respect for longevity and consistency rather than headline yield. The 65-year growth streak demonstrates management discipline through multiple economic cycles. The 39% payout ratio provides cushion for continued increases, and recent 4-8% annual growth rates exceed inflation by a meaningful margin.

The 1.65% yield won’t satisfy investors seeking immediate income, particularly when compared to higher-yielding alternatives or even Target’s 4% quarterly payout. But for investors prioritizing dividend growth over current income, Lowe’s combination of modest yield, strong balance sheet, and consistent increases merits consideration. The stock’s 80.28% five-year total return demonstrates that capital appreciation can compensate for a lower starting yield.

The dividend quality ultimately hinges on housing market resilience. If consumer spending on home improvement holds steady despite affordability pressures, Lowe’s can sustain its growth trajectory. If not, the company’s financial flexibility should allow it to maintain the payout while growth slows. Either scenario supports the dividend, though the growth rate may moderate from recent levels.

link